Response to Economic Stimuli ? Market Fall ?

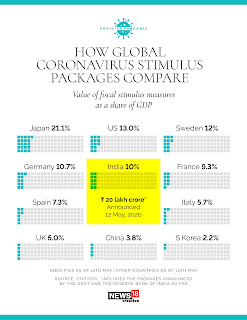

We are all excited about the 200,000,00,000,000 package

announced by Prime Minister Modi and are trying to find its possible and

plausible impact on our lives. If we try to do the math the figure comes out of

be roughly 10% of our Gross domestic product (GDP).

It would be very interesting to know what it comprises of or

what things contribute, who contributes to it and where do we stand.

Sector

|

Contribution

|

Primary

|

16.00%

|

Secondary

|

29.00%

|

Tertiary

|

55.00%

|

To

simplify Primary is Agriculture based and allied business, Secondary is

Manufacturing and tertiary is the

Service sector.

Stock markets initially rallied from the bottom created by

end of March almost falling 38 % from the peak and by April we saw almost an

unreal rally which recouped almost half of the lost ground and now the stimulus

package is here markets response to stimuli was that of a shock.

I had to recount the number of zeros, still unsure if I

missed one in this 20 trillion rupee figure, sure this looks massive a look at

its break up and how much have we done to save the economy versus the globe.

Ok so India's GDP and

most importantly per capita GDP is not comparable on an absolute basis the

numbers don't look small by any stretch of imagination. Let's have a look at

them in the table below.

|

| GDP Ratings |

I have taken data from the IMF website as you shall find

varying data from all sources, if we

rank countries by nominal GDP in absolute terms we are amongst the so called as

fantastic five and we proudly can pump

our fist but the moment we take our population in count we realise we

hardly make a cut amongst the top 150 nations ( 144 rank). So agreed we have

problem of plenty and we are or less

cognizant of the same and unlike our bigger communist counterpart we are not

forcing issue of one child/ two child policy. Keeping this context must say

it's a bold move. And i don't give that deal of priority to stimulus as much as

the reforms the so called as process of removal of impediments in economic

growth.

Now the so called as

LLL/Labour, Land& Legal reforms can be a second turning point in her growth

story. Last was in 1991 when Dr. Manmohan Singh gave the historic speech

and we are what we are where we are due to his moves on LPG /Liberalization,

Privatisation and Globalisation. Mind you very well as genius as it may sound

it was not a proactive visionary move, it was very much forced upon when we had

the Balance of payment crisis. So let's

accept we are like that kid who always chills for better part of the year and when grey clouds of semester exams loom

large and there is no way out he opens the book. This time around its not

much different, we have made the move of big bang reforms only when we are

pitted against the wall. Now the million dollar question why is market

reacting the way it is ?

The devil lies in the detail. If you look at the stimulus

from where the Govt is going to fund this amount ? If you look at major part of the stimulus has

to be funded by borrowing. Now it's estimated that a borrowing in excess of INR12,000,000,000,000 ( 12 lac Cr) will be needed to plug the Gap.

Most of it is going to come from borrowings. Which means

India's Debt to GDP will sky rocket, on account of piling of new debt and fall

in overall economic .

Which may put bond yields under pressure and there is a fear

that India's sovereign rating might be under threat of being downgraded.

All these factors make the market nervous in Short term.

Well in short term it's never behaved rationally, so makes it impossible to

predict. Successful traders tend to react and chase momentum/trend rather than

pre-empt the market. Well there is no denying the Labour and Land reforms will transform the landscape and

we shall be the new destination who might just steal a part of thunder from

China.

And I choose my words carefully, what China has achieved in

last decade has been impeccable to replicate that will take lot of dogged

determination and statesmanship from our leaders and sheer obsession to achieve

by our entrepreneurs.

All in all these are exciting times we live in and coming

decade shall for sure be better than the previous ones.

Excellent rendition of the ecconomic stimulus package & the understanding the effect of the same. India has a golden opportunity to take advantage of this crisis. The markets will fall in line in due course if this pandamic doesn't stretch too long.

ReplyDeleteAgreed ... India can really make the next two decades its own..the per capita GDP can move from. 2.4K to 10K

DeleteVery Informative & well studied article

ReplyDeleteThanks !

Delete